The Definitive Guide to Bankruptcy Business

Wiki Article

The Ultimate Guide To Bankruptcy Bill

Table of ContentsThe 25-Second Trick For Bankruptcy BusinessThe Buzz on Bankruptcy InformationTop Guidelines Of Bankruptcy BillAbout Bankruptcy AttorneyBankruptcy Court Can Be Fun For EveryoneSome Ideas on Bankruptcy Business You Need To Know

:max_bytes(150000):strip_icc()/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png)

Leinart Law practice want to offer info so that you know the details of both of these terms in addition to the other sorts of personal bankruptcy you must be thinking about insolvency as a strategy. Debtor: the person or service filing personal bankruptcy. A debtor and also spouse can submit a joint application in bankruptcy.

The 25-Second Trick For Bankruptcy Bill

The borrower's crucial "task" is merely to be honest as well as participating throughout the process. Lender: the individual or business which has a case against a borrower. That insurance claim is typically simply for an amount of cash owed on a financial debt, but can also consist of responsibilities on an agreement or for an injury that are not of a particular quantity.They have a tendency to be more entailed if they have security protecting their claim, or have some personal axe to grind (such as ex-spouses and ex-business partners). Bankruptcy Clerk: the person, and all of his or her staff members, that deal with the clerical facets of the insolvency court (bankruptcy attorney near me). These individuals approve your instance for filing, preserve your personal bankruptcy file, and also manage a lot of the paperwork having to do with your insolvency instance.

Examine This Report about Bankruptcy

Insolvency Court: the person who is eventually in fee of your situation. Personal bankruptcy judges are assigned to terms of 14 years. In the majority of straightforward Chapter 7 and 13 instances, you will not have any occasion to satisfy the insolvency court appointed to your situation.In numerous means, bankruptcy can aid individuals and also families get a fresh begin (bankruptcy bill). Here are a few of one of the most common factors people file for insolvency. Joblessness or an abrupt decrease of earnings is one more top reason people submit bankruptcy, specifically if the borrower is the main service provider for their family members.

Some Known Details About Bankruptcy Lawyers Near Me

Minimum settlements are made however rate of interest maintains accruing. Quickly a $50 purchase is currently $150 as a result of interest and also late fees. While debt combination can assist, often insolvency is the only means to reach a better financial future as financial debt loan consolidation calls for that all (or most) of your financial obligation be paid back while bankruptcy can entirely eliminate the financial obligation.

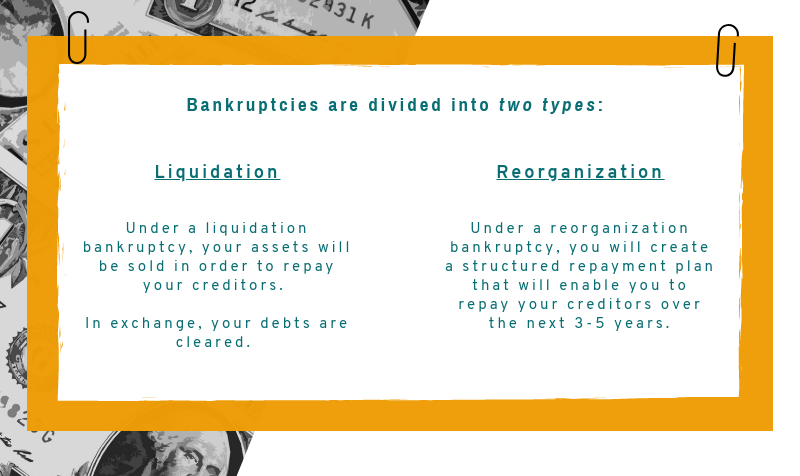

Based upon the details of your case, you will intend to file under a certain chapter. The various personal bankruptcy options are arranged right into different "Chapters" based on where each is found in the U.S. Bankruptcy Code. Phases 7 and also 13 are mostly used by individuals with small company or customer debt.

The smart Trick of Bankruptcy Court That Nobody is Talking About

amount of customer and/or company financial debt. This is mainly for corporations. Phase 9 is for city, area, as well as other governmental bankruptcies.Chapter 9: a restructuring of financial obligations of a city, region, or other neighborhoodof a state.Extremely couple of are filedduring the last thirty years or two of this Phase's presence, between only 1 to 18 instances have actually been filed per year.Chapter 11: a" reconstruction "of financial debts. It takes a great deal of idea as well as planning in order to determine if bankruptcy is right for yoursituation. There are several factors why individuals choose personal bankruptcy as my review here well as there are crucial things to take into consideration. Right here are a couple of things that you need to take into account when making a decision whether to apply for bankruptcy. You have to be qualified for filing. This is identified by your financial debt, kind of debt, income, your capacity to pay, and various other variables. If you consult with a bankruptcy lawyer, they can give you an excellent idea if you would certify, as well as if not, what various other alternatives are available for you. Nevertheless, owing money can commonly be worse. Insolvency can help you return on course economically; you just have to evaluate the advantages and establish whether it is the finest fit for you. Recently, a variety of websites, books, as well as diy packages have shown up, providing suggestions and support in just how to apply for personal bankruptcy without a lawyer. Consequently, when filling in kinds, it is necessary that the appropriate info be supplied and also details legal procedures abided by.

The Buzz on Bankruptcy

If you filed under Phase 13, any type of residence or car debts( the amount you are behind)and also any type of various other financial obligation being dealt with via the insolvency will certainly be rolled right into the month-to-month repayments accumulated by the insolvency trustee. Also if your employer in some way finds out that you have actually submitted for bankruptcy, under the regulation they can't do anything to you due to the fact that of your insolvency alone. The bankruptcy procedure is governed by the Federal Regulations of Insolvency Procedure(or the"Bankruptcy Policy" )and the local guidelines of each insolvency court.Report this wiki page